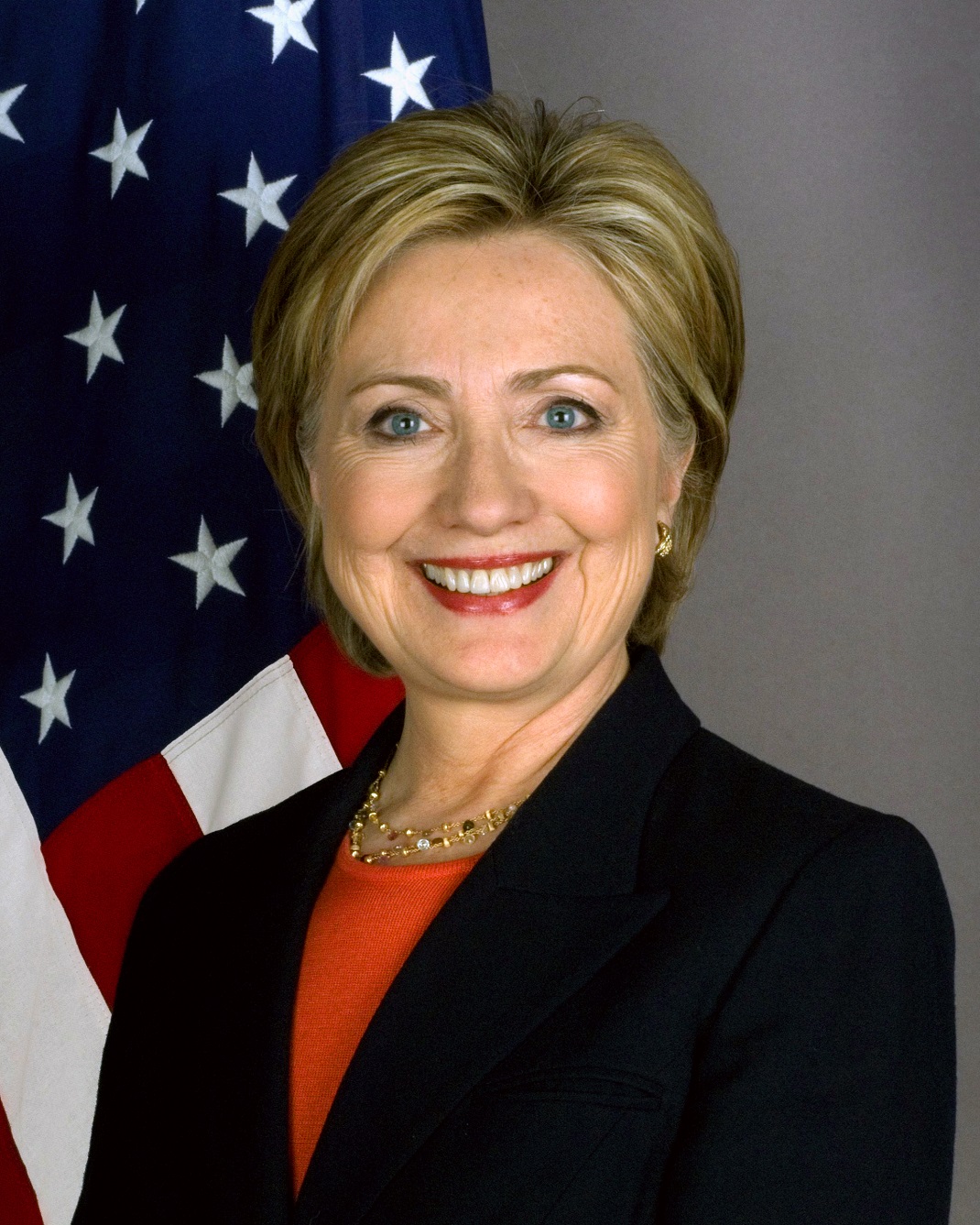

Clinton Criticizes Skyrocketing Pharmaceutical Costs

Hillary Clinton has made reducing out-of-pocket drug costs and stopping pharmaceutical industry abuse a staple of her campaign presidency. A new ad is rolling through… Read More »Clinton Criticizes Skyrocketing Pharmaceutical Costs