- About Us

-

Solutions

Other ServicesThe Payment Experts

Our integrations connect you with the best tools for your business.

Integrations - Partner

-

Industries

- Online Gaming & Casinos

- Bail Bonds

- Multilevel Marketing

- Online Furniture Sales

- Bad Credit Merchant Accounts

- Calling Cards

- Moving & Transportation

- CBD Oil

- Travel & Timeshares

- TMF Merchants

- High-Ticket Accounts

- Jet Charters

- Penny Auctions

- Educational & Seminars

- VOIP and Telecom

- Online Firearm Sales

- Cigars and Pipes

- Online Ticketing Sales

- High Volume Merchants

- Debt Consolidators

- Software and E-Book Merchants

Industries - Contact Us

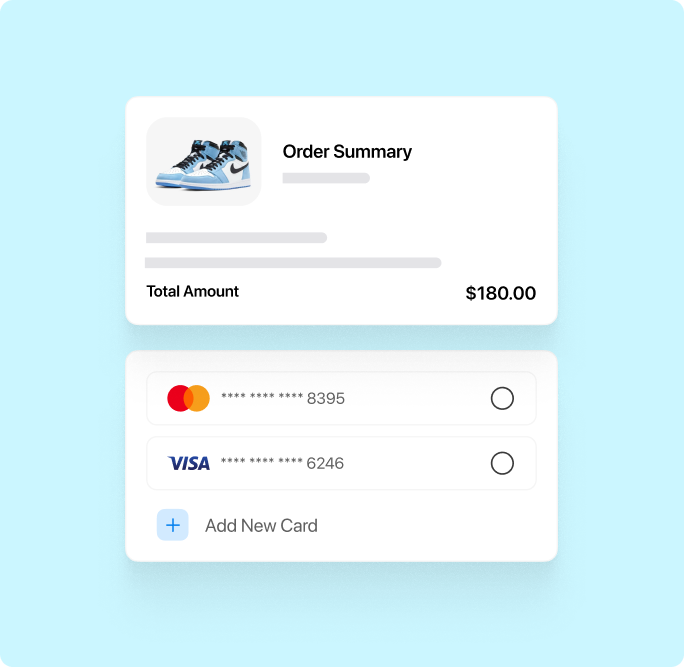

Payment gateways

Payment Gateways: Secure Solutions for Your Business

Obtaining a payment gateway is never easy. Fortunately, EMB’s application process is quick and easy. We accept 98% of all merchants, ranging from big to small businesses. EMB also helps many high-risk and new merchants who were rejected by other processors.

Consider high-risk payment gateways

Reduce errors

When customers use the check-out portion of a merchant’s site, they expect a seamless process. High-risk payment gateways keep the check-out process error-free and avoid losing customers.

Increased security

High-risk payment gateways provide merchants with adequate security to ensure quick and safe transactions between merchant websites and credit card processors. Customers stay secure while shopping on your site.

Accept various currencies

Not only are high-risk payment gates some of the savviest technology available for routing systems, but payment gateways also accept various kinds of currency. By accepting several currency types, merchants save time and energy.

Easy access

High-risk payment gateways can be easily accessed and used with modern web portal interfaces and reports. Application-programming interface (API) access to gateways and report data provide merchants with additional control.

- Best Merchant Services: Top Providers for Your Business NeedsThe success of your ecommerce business depends on conversion. A large part of creating these… Read More »Best Merchant Services: Top Providers for Your Business Needs

Merchant support for online payment gateways

When it comes to online payment gateways, eMerchantBroker acknowledges that businesses have an array of individual needs. EMB’s objective is to help clients arrive at personalized solutions that ultimately meet those needs.

- Anti-fraud protection: Safeguarding your business is critical to success because even a seemingly small mistake can end up wreaking havoc.

- User-friendly: Payment gateways must be user-friendly to prevent customers from getting frustrated and giving up on purchasing your products.

Required documents for payment gateways

To start accepting payments through a high-risk payment gateway, merchants need to fill out our quick and convenient online application. In addition to the application, you will need to submit the following:

- Merchant account documentation

- Your SSN or Employer Identification Number

- Three months of financial records

- Three months of processing statements

- Valid identification

- A working website with appropriate terms and conditions

What you should know about the online payment process

Online payments are complex, but EMB can help at every step.

EMB helps clients in various industries with payment options

High-risk payment gateways for a range of merchants

“Customers were experiencing small errors that led them to quitting transactions before purchase until we contacted EMB. They helped us create a high-risk payment gateway that keeps the process free of errors.”

antique seller Anonymous

“EMB’s high-risk payment gateways keep our customers safe and secure. Not only has this increased the number of customers we have, it has also increased the satisfaction of customers who use our website.”

clothing shop owner Anonymous

A high-risk payment gateway is a payment processing solution specifically designed for businesses that operate in high-risk industries or have a higher likelihood of chargebacks, fraud, and other financial risks. These gateways offer additional features like advanced fraud prevention, chargeback management, and more robust security measures to ensure smooth transactions and minimize risks associated with high-risk businesses.

High-risk payment gateways help merchants by providing a secure and seamless checkout process while reducing errors and increasing security. These gateways are designed to cater to businesses operating in high-risk industries and accept multiple currencies, making transactions convenient for customers worldwide. High-risk payment gateways can also be easily accessed and used with modern web portal interfaces and reports, providing merchants with additional control.

When selecting a payment gateway for your high-risk business, consider factors such as the level of security and anti-fraud protection offered, user-friendliness, compatibility with your website, the ability to accept various currencies, and the gateway’s reputation in the industry. It’s essential to choose a payment gateway provider that understands your business’s unique needs and can offer tailor-made solutions.

Merchants can access high-risk payment gateways by partnering with a payment processor like EMB, which specializes in high-risk merchant accounts. To start accepting payments through a high-risk payment gateway, you will need to complete an application process and submit the required documentation. Once approved, you can integrate the payment gateway with your website and start accepting transactions securely.

Still have questions?

If you can’t find the answer you’re looking for, please reach out and chat with our team.

Get in touch