- About Us

-

Solutions

Other ServicesThe Payment Experts

Our integrations connect you with the best tools for your business.

Integrations - Partner

-

Industries

- Online Gaming & Casinos

- Bail Bonds

- Multilevel Marketing

- Online Furniture Sales

- Bad Credit Merchant Accounts

- Calling Cards

- Moving & Transportation

- CBD Oil

- Travel & Timeshares

- TMF Merchants

- High-Ticket Accounts

- Jet Charters

- Penny Auctions

- Educational & Seminars

- VOIP and Telecom

- Online Firearm Sales

- Cigars and Pipes

- Online Ticketing Sales

- High Volume Merchants

- Debt Consolidators

- Software and E-Book Merchants

Industries - Contact Us

Partners

Building a future together

When you choose to work with EMB, you’re choosing one of the industry’s most reliable and dedicated payment enablers. We welcome you to join us as an Agent or ISO.

Meet Atlas. Our full-featured online

agent portal and custom user app.

Robust reporting

Stay on top of your business with our comprehensive reporting platform that keeps you informed with essential data and offers valuable insights into all your transactions.

Built for merchant services

We built our app from the ground up, developed to handle the dynamic requirements of high-risk payments. It’s the first portal tailored specifically to our industry.

Real-time notifications

Keep track of all your important internal communications in real-time; monitor any notifications from your administration and operations team members as they happen.

Support specialists

Dedicated customer care team

Our customer service teams are ready to talk to merchants and agents, always providing the exceptional service, care, and support that EMB is known for.

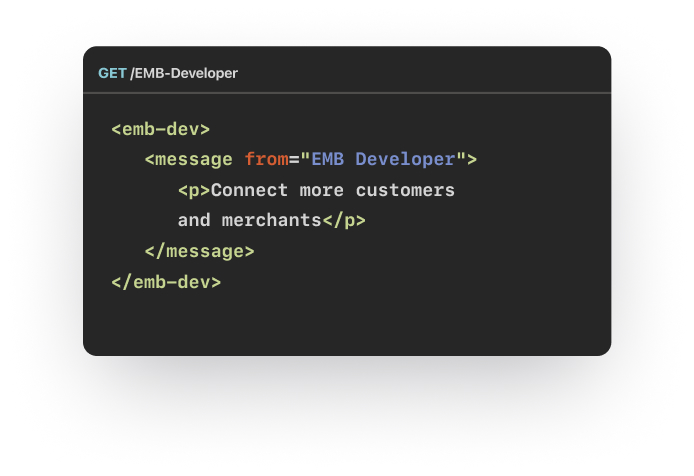

Contact usApps built for modern business needs

Utilize EMB APIs to build robust custom eCommerce experiences for your customers.

Learn about developer solutions

ISO Partnerships

EMB offers our ISOs true flexibility – to build and grow their businesses. Participate in a proven, expansive operation with unlimited profit potential. We provide marketing tools, resources, and support to sell EMB products and services within your market.

Our partner program rewards you with both short and long term capital that you can invest back into your business.

- Choose from a variety of competitive revenue sharing programs for the right compensation model focussed on high risk accounts

- Address the needs of nearly every industry, thanks to our comprehensive array of merchant transaction processing solutions

- Access to Atlas – custom CRM and reporting tools designed to give you control of your business

Participate in a proven, expansive operation with unlimited profit potential.

- Potentially generate more revenue with a generous multi-option compensation structure, including bonus incentives and discretionary residual and retirement buyout arrangements

- Increase your customer satisfaction with our Customer Service Department that supports merchants 24 hours a day, 365 days a year

- Expand your ability to serve nearly every industry and process transactions for small- to medium-size merchants