- About Us

-

Solutions

Other ServicesThe Payment Experts

Our integrations connect you with the best tools for your business.

Integrations - Partner

-

Industries

- Online Gaming & Casinos

- Bail Bonds

- Multilevel Marketing

- Online Furniture Sales

- Bad Credit Merchant Accounts

- Calling Cards

- Moving & Transportation

- CBD Oil

- Travel & Timeshares

- TMF Merchants

- High-Ticket Accounts

- Jet Charters

- Penny Auctions

- Educational & Seminars

- VOIP and Telecom

- Online Firearm Sales

- Cigars and Pipes

- Online Ticketing Sales

- High Volume Merchants

- Debt Consolidators

- Software and E-Book Merchants

Industries - Contact Us

Business funding

Fast & flexible business funding made simple

No dream should die before it gets a chance to thrive. At EMB, we help you get the funding you need so you can focus on what you do best: growing your business and providing value to your customers.

Unique solutions for unique needs

ACH business funding

We examine your monthly sales revenue based on your gross deposits and get you funding. No merchant account required.

Chargeback protection

We keep your chargeback ratios below 2% and your business safe from fraud with real-time data.

Merchant cash advances

On average, we get a business working capital in 5-7 business days.

High-risk industries

No matter your industry — from designer fashions to firearms — we make it possible for you to get the funding you need.

- Mastering Credit Card Processing for High Risk MerchantsEffective credit card processing for high risk merchants is pivotal in order to sustain and… Read More »Mastering Credit Card Processing for High Risk Merchants

Helping your high-risk business eliminate threats

Business funding differs from a traditional loan. Instead of high-interest rates, collateral, and monthly payments, business funding gets you the help you need without holding anything over your head. Plus, we help you avoid the real threat to your business: chargebacks.

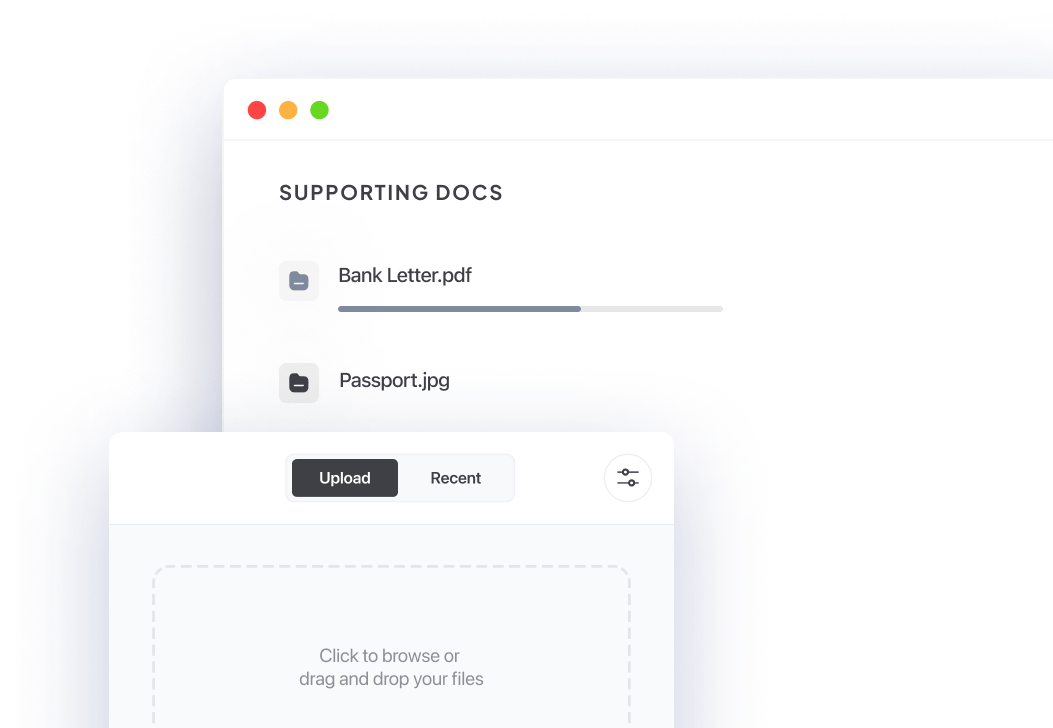

What documents are required?

We make the online application process simple. While we can’t promise guaranteed approvals every time, we can promise a fair process. In addition to a completed application, you must provide the following documents:

- Copy of passport or ID

- Corporate documents

- One month of business bank statements (if available)

- Bank letter or confirmation of deposit bank info showing business name, IBAN or Swift information

Here to help you help yourself

$0 application fee, $0 start up fee.

Don’t just take our word for it

“Terry knew that not working with a single processor was causing inefficiencies, and she was unnecessarily risking her business. Moving to a single processor turned a complicated payment structure into a seamless, cost-effective operation.”

Terry McAvoy, owner of an in-store and online clothing business

“Sanj Kumar’s ecommerce business experienced an influx of fraudulent chargebacks from international customers due to the nature of its luxury business. Experiencing regular instances of fraud was having an impact on profit margins and the future of its merchant account. Based on EMB’s knowledge of the industry and broader fraud trends, we were able to offer Sanj timely and effective policy changes to his fraud protection program. ”

Sanj Kumar luxury ecommerce business owner