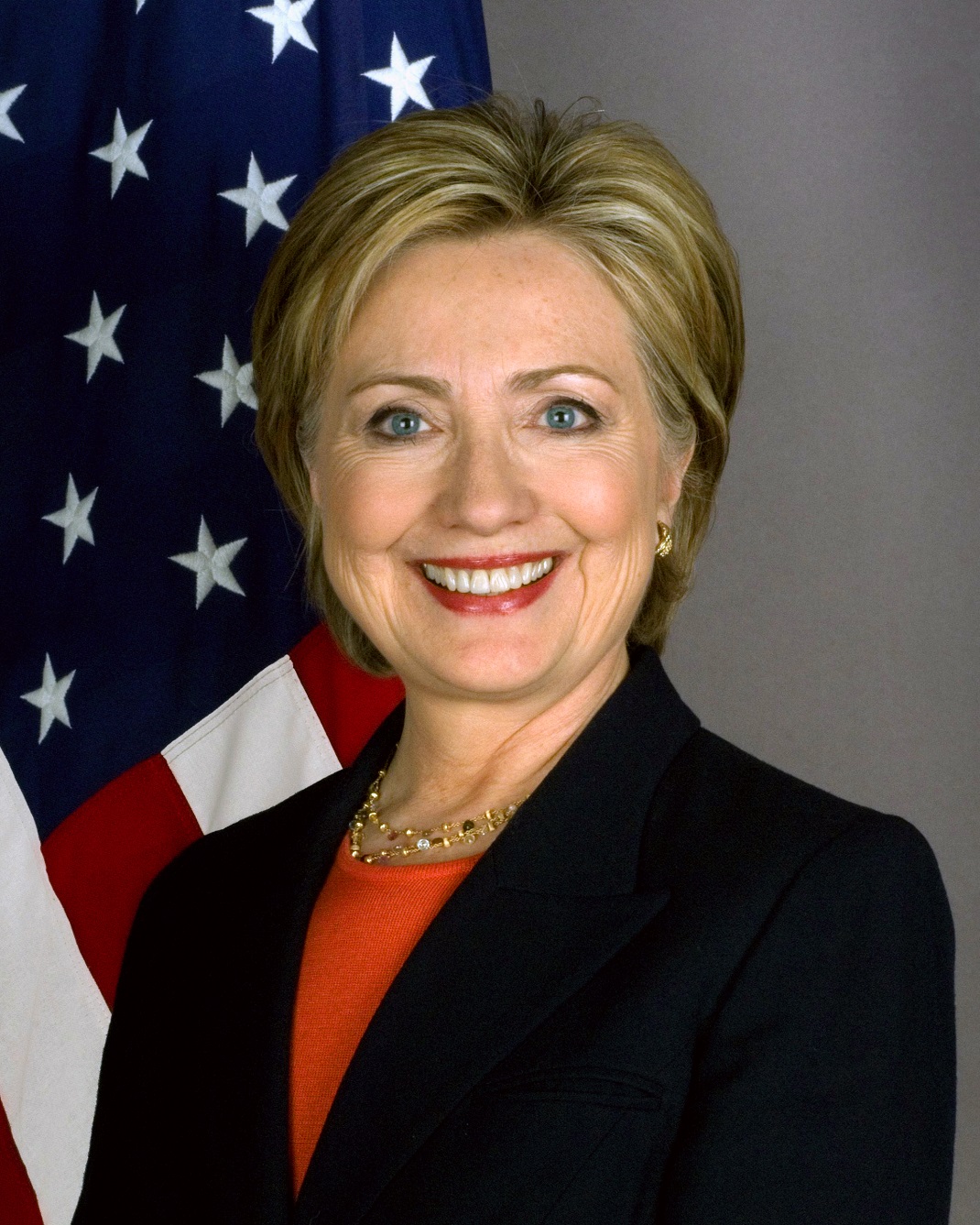

Hillary Clinton has made reducing out-of-pocket drug costs and stopping pharmaceutical industry abuse a staple of her campaign presidency. A new ad is rolling through New Hampshire and Iowa that has Clinton criticizing the dramatic increase in the drug Daraprim. The ad launched right after the drug’s producer was purchased by a hedge fund manager who raised the price from $13.50 to $750 a pill. Clinton calls the price hike outrageous and pledges to curb the out-of-pocket costs that have caused many Americans to avoid seeking treatment, stop taking important medications, or going broke to pay for medications. The end of the ad features a commentator who says the hedge fund manager may be reducing the price of Daraprim after the scathing ad ran.

Drastic increases in drug costs like the one featured in Hillary Clinton’s ad have many individuals in the United States and Canada turning to online pharmaceutical companies. Consumers are turning to online pharmacies who sell drugs at much cheaper rates than brick and mortar pharmacies. American and Canadian based online pharmacies not only give consumers access to much cheaper drugs and can deliver them, in some cases, faster and with less hassle. Online pharmacists have a much larger clientele served from one location with only a fragment of the operating costs that large pharmacy chains have.

Utilizing online pharmacies is a legitimate choice when the pharmacies are reputable. But the danger of online pharmacies is that many are foreign and not monitored by the FDA. As a result, there are quite a number of online pharmacies that are not legitimate. Some of these pharmacies give consumers fake drugs or mislabeled bottles.

If you are an online pharmacy merchant, now is a good time to open your pharmacy merchant account. eMerchantBroker.com is the number one pharmacy merchant account provider in the nation. EMB provides check processing services for online pharmacies to keep profits flowing. This is a convenient way for pharmacy merchants to utilize check-based payments that deposit funds more quickly to merchant accounts. Our account managers are the most experienced in providing check processing services and other services for online pharmacies. Start your application today.