How Small Businesses Can Accept Credit Card Payments Online

The ability to accept credit card payments is critical for modern businesses. Whether you sell and ship products or people can pre-order and pick them up in person, offering online payments can have a huge impact on your bottom line. It allows you to offer the convenience of online shopping without the hassle of checks or cash. You can also gain an edge over competitors who aren’t accepting credit cards yet.

While it may sound simple, some businesses in high-risk industries may find that getting a merchant account and accepting online payments is more challenging than others. The technology is there, but how do you get started?

What is a merchant account?

A merchant account is a bank account that allows you to receive payments from credit and debit cards. This can be done online or at the counter of your business location. A merchant account allows you to accept payment anywhere, anytime, without having to receive cash or checks. Not only is this convenient for the customer, but it’s also convenient for the business. Having a merchant account is one of the pieces you need to accept credit card payments online.

What is a payment gateway?

A payment gateway is a middleman between your website and your merchant account. The payment gateway securely transmits payment information to the merchant account, which in turn processes the transaction. Payment gateways work with both online and mobile transactions, and they can be integrated into your website or app.

What about high risk merchant accounts?

Some industries are considered higher risk than others. Companies that sell things like CBD, weapons, and even some nutritional products may find it more difficult to get a merchant account where they can deposit money. This may take a little more time, but often local banks and credit unions have merchant services that include payment platforms for these high-risk businesses.

How to set up payments on your website or app

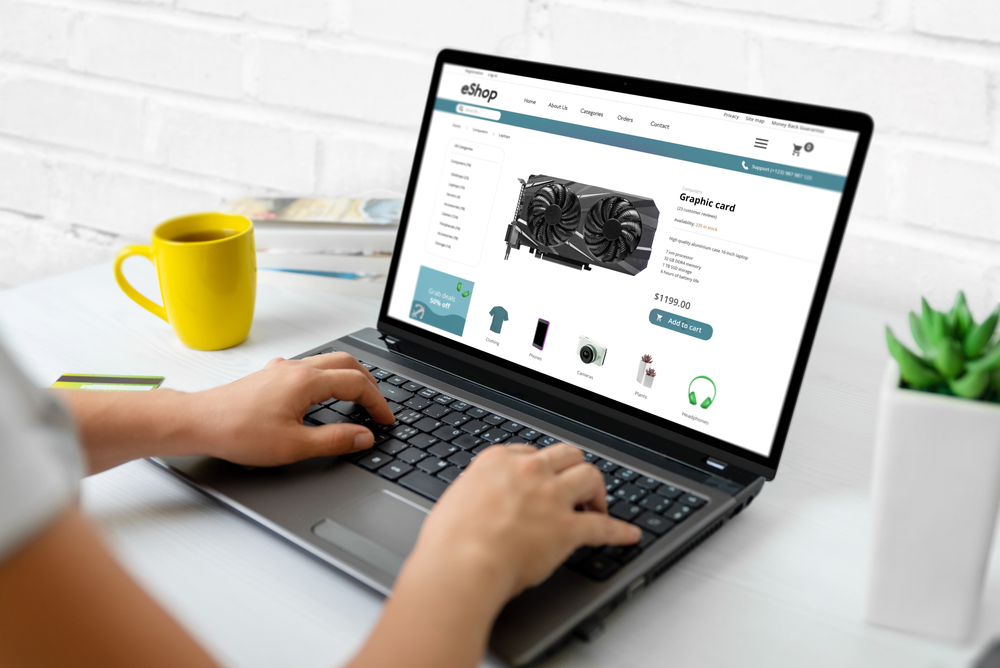

It’s important to have an online presence for your business. Some people use a social media site, but it’s much more effective to use a website of your own. If you have a website or an eCommerce app, and would like to start accepting credit card payments online, there are a few ways you can do this.

Create a website first.

First things first, you need to set up a website or upgrade your current one to accept payments. Creating a website requires:

- A website platform

- A host

- A domain name

Integrate a shopping cart into your site

A shopping cart is a software program that allows customers to purchase multiple items from your store in one session. A customer can add products to their virtual cart and then check out by either paying online with a credit card or by printing out an order form and mailing it along with payment to you. The most popular carts are offered by companies such as Shopify, Magento, and BigCommerce. A shopping cart will allow you to sell products online if you also accept online credit card or debit car payments.

When integrating a shopping cart into your site, there are a few factors to consider:

- How much do they cost? Most eCommerce platforms charge monthly fees based on the number of sales you make and/or the amount of storage space used on their servers.

- Are there any setup fees? Some shopping carts may require additional software or plugins installed on your web server before they’re ready for use—this could cost several hundred dollars depending on what type of shop system you choose.

- Are there any other hidden costs? Some companies require developers’ time for installation—though this isn’t always necessary if there is already existing integration between these two technologies in place.

- Is the cart easy for the customer to use? It’s important to ensure that the cart is simple for the end user to use. You don’t want to lose people in the purchase process because the cart is too clunky.

- How easy is it for me to add new products? Being able to update inventory and add new products should be relatively simple for the business owner.

- Is it easy to add to the site? Some eCommerce solutions can be added simply to a site, but others are not easy to integrate and may require a developer.

- Is it app friendly? It’s also important to find payment processors that are app friendly and work well on smartphones and other devices. This makes it easier for customers who use their phone to make these purchases.

Start accepting credit card payments online

Once you have the site up and ready and your products are uploaded, you can start accepting payments online for your products and services. It’s important to note that if you offer any type of high-risk products, that you may need to incorporate specific disclaimers on your site. While these high-risk categories are legal, it’s important to cover your business to ensure that the credit card payment company has no reason to take down your site or withhold funds from you.

It’s important to know what fees you’ll be charged by your processor and how they’re calculated as well. This will ensure that you can set the right prices for your products to cover the fees and still make a profit. One reason why it’s important to know what kind of fees you can expect is that most merchants don’t realize just how much money they end up paying in processing charges until they get their first statement from their payment processor after setting up their account.

What constitutes a high-risk business?

If you choose to accept credit cards online, there are certain transactions that may be considered high risk and could cause your account to be limited or suspended. If you’re in one of these businesses, you need to make sure you use a payment processor that is known for accepting payments for these kinds of businesses.

The following activities are considered high risk:

- Online gambling sites

- Adult sites

- Sites that sell alcohol or tobacco products

- Sites that sell prescription drugs

- Sites that sell weapons or ammunition (including firearm parts)

Why are high risk sites targeted?

Because these high-risk products and services can be used to also commit crimes, some companies are leery about being associated with them. Also, because there isn’t a way to guarantee the age of the person purchasing the products or services online, it opens the opportunity for underage people to buy or consume content not meant for them. If you’re in a high-risk industry, you can seek out guidance from local banks and services that already provide merchant accounts and payment processing for similar businesses.

Use a secure payment gateway

No one wants to be the target of a cyberattack. This is why it’s critical to not only use a secure 3rd party payment processor for credit cards but to also maintain the security of your website. You can protect your data, your customers, and your business by ensuring you have the proper level of security. Using firewalls and anti-virus software are two of the most important and often the simplest options.

It’s all about the risk

Accepting credit card payments online can be risky. With the rise of credit card fraud and high-risk merchants, it’s important to understand your options when it comes to accepting payment methods online. High-risk accounts may also come with additional fees and caveats so that the credit card vendor is protected if anything illegal happens as a result of your business.

Some have to use offshore merchant accounts to accept credit cards. Others find specialized companies that can verify the age of a person at the point of sale more effectively.

While an offshore merchant account might sound like a good solution, it introduces its own unique set of issues. First, these accounts are not FDIC insured and therefore are not protected against fraud or bankruptcy. In addition to this risk, there is also the fact that offshore accounts charge higher fees than domestic ones and have lower credit limits as well as fewer transaction options.

Simplify things with an online store that’s already integrated

When you’re first getting your business up and running it might make more sense to use an online store that already has integrations that allow you to accept payments online. While some people use Etsy or even Amazon to sell, there are other ways to get your products out there from your own domain name.

There are several ways to integrate WordPress for instance with a variety of different payment processors and online storefronts. While not native to the WordPress platform, they were developed precisely for WordPress and operate seamlessly once installed.

Create a mobile app

People love apps. When you’re ready, consider offering a mobile app for your business. This can streamline and simplify purchasing for your customers and makes it easy to make updates and upgrades. A mobile app can be connected to any payment gateway so that you can continue to

Make sure you’re using the right payment processor. There are multiple options available, but not all of them fit every business. Some processors work better with certain industries or e-commerce platforms than others, so make sure you find one that will meet your needs before signing up.

Set up your own High Risk Merchant Account Today!

Setting up a way to accept credit card payments online is important for modern businesses. Thankfully, technology has simplified the process and made website integrations easier than ever before. With the right tools and some know-how, you can accept credit cards online. You’ll need to set up a merchant account with a payment gateway, which will help you process payments securely. Then all you have to do is integrate your shopping cart into your website or app and start accepting payments.