We are the Best at What We Do

Our team of professionals each have years of experience in the electronic payments industry and have helped thousands of “hard to approve” merchants get a domestic merchant account. Our full suite of electronic payment processing solutions ensures we can help virtually any merchant accept credit cards and checks electronically.

- Fast approvals in 24 – 48 hours.

- No set up fees for most merchants.

- High Risk merchants approved.

- High volume solutions: load balancing gateways and multiple MIDS.

- Chargeback protection & chargeback prevention programs available.

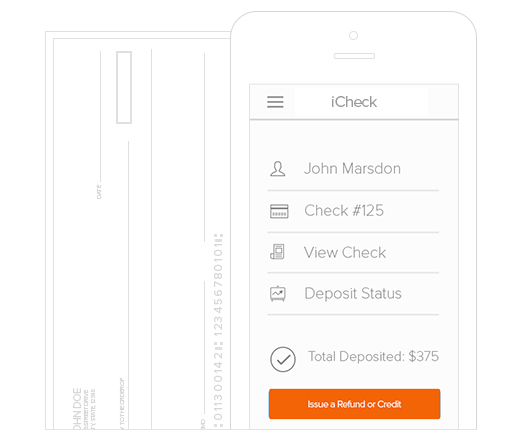

- iCheck Check Processing service, featuring quick payments.

Just Some of What We Offer

We’ll get your High Risk Merchant Account Approved!

This is better than ACH. Our iCheck service provides merchants with next day payments. We approve 99% of our applicants.

We fund merchants that others won’t. Bad Credit? No Problem!

We have a comprehensive list of Gateways, including our own.

Let Us Work for You

- Experienced Staff: Our Company is built on experience, let our experienced staff help you on your journey.

- Proven Support: We service a diverse list of customers and have vast knowledge to support them.

- Speedy Signup: Our application only takes a few minutes, and before you know it you’ll be up and running.

- Real Results: Our merchants, both big and small, are building successful businesses on our platform.

Merchant Accounts that Count

EMB is a full service provider, offering Merchant Accounts and services for any and all types of businesses. We offer a wide selection of Payment Gateways, POS Solutions, Business Funding, Check Processing solutions, and a full support platform that ensures you’re never out of reach from getting the help you require, right when you need it.

When we say we’re here for you, we mean it!

Seriously, we have been known to keep camping gear in the office, just to make sure we can answer your support questions quickly. We’re not just that dedicated to customer service, but to our full suite of services, which were’ constantly improving and adding to every day

Sound like we’re the right fit for you?

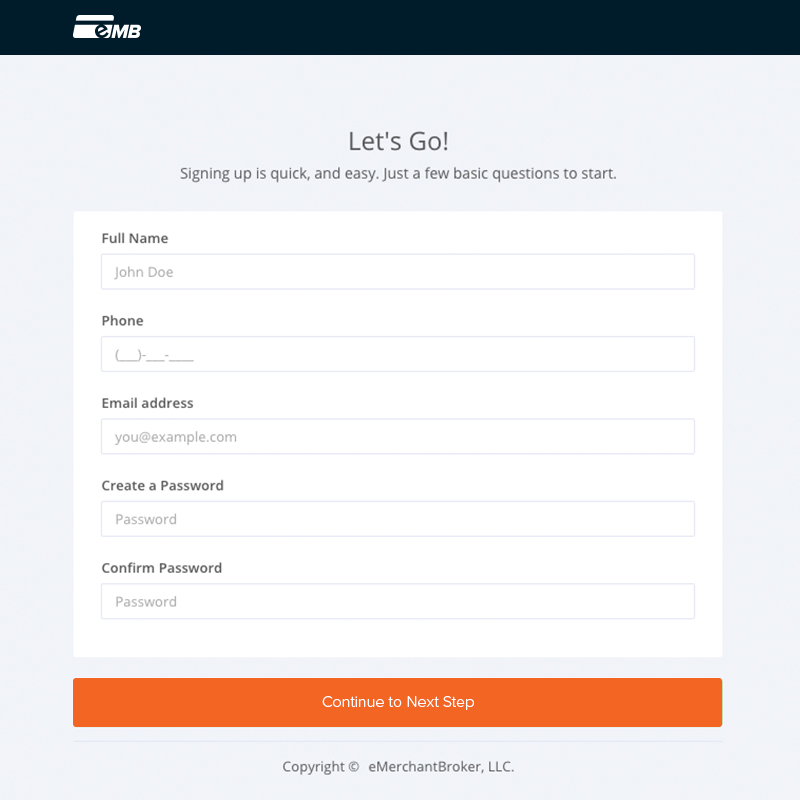

Our Application is Painless

You’ll just need a few minutes, some basic information, and a few pieces of documentation. We’ve streamlined our application process down to the minimum required fields, making it an efficient, and painless process for our merchants. When we say it’s fast, we mean it. Most of our merchants can complete an entire app in half the time it takes to make a cup of coffee.

Ready to get started?

Let us know how we can help you. Do you still have questions, or want to speak to someone to get assistance with a specific requirement you have? WE’RE HAPPY TO HELP!

If you have no more questions, why wait?

START YOUR APPLICATION, TODAY!

Check Processing

Checks by Web, Checks by Phone, Paper Guarantee, and our new iCheck (instant check processing) solutions are just some of the ways in which we’re making it easier for our merchants to process payments and build successful businesses. This isn’t the archaic ACH solutions you’re used to; our services use the latest in check processing technologies.

GET STARTED TODAY!

Our Premiere iCheck Service

iCheck is a means of electronic check processing that facilitates faster funding on a wider variety of checks. It also has fewer restrictions than ACH and is quickly becoming the solution our merchants turn to for accepting check-based payments. This flexibility, also known as Remote Deposit Capture, is ideal for many sales environments.

Checks can be accepted at the Point of Sale or when the consumer is not present. This is the future of check processing, and we’re excited to get you set up with your iCheck account!

Need Fast, and Efficient Check Processing?

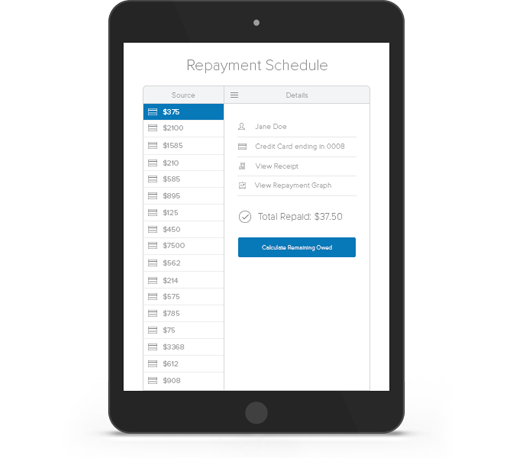

Cash Advance

Need funding today? We understand your capital needs better than anyone. Our Business Funding services are used by many of our merchants to kick start, or to help sustain, their businesses. Applying is fast and easy, and you only need a few pieces of information about your business to get approved.

WHY WAIT?

Payment Gateways

We offer a wide variety of payment gateways, including our own. Don’t know which to choose? You can’t go wrong with the EMB Gateway, which provides you with a full suite of useful features.

Confused?

Choosing the right Gateway can be daunting. Let us help you through the process by providing options based on your needs. Give us a call, EMAIL US, or GET STARTED WITH OUR APPLICATION RIGHT AWAY.

With EMB, you can never make the wrong choice.

NEED MORE INFO? SEE OUR FULL LIST OF GATEWAYS

CHECK PROCESSING

Checks by Web, Checks by Phone, Paper Guarantee, and our new iCheck (instant check processing) solutions are just some of the ways in which we’re making it easier for our merchants to process payments and build successful businesses. Learn More…

CREDIT CARD PROCESSING

You probably didn’t know how many industries are considered high risk. Even things you use daily, like transportation, or your favorite dietary supplement, fit into this category. Our experienced team is ready to guide you through the process of applying for a high risk merchant account. Learn More…

CASH ADVANCE

Need funding today? We understand your capital needs better than anyone. Our Business Funding services are used by many of our merchants to kickstart, or help sustain, their businesses. Learn More…

PAYMENT GATEWAYS

Want to get up and running in no time? We can get you set up quickly, get you started with a Payment Gateway, and help you identify additional services, like Chargeback Protection, so you can cater your merchant account to your needs. Learn More…

It only takes a few minutes, and you’ll be happy you chose us!

Consistently Voted the Best High Risk Provider by Industry Experts

A PROVEN PLATFORM

We’ve built a platform that works for you. We’re continuing to add new features daily, and expanding to meet the needs and requests of our customers.

SUPPORT SUPERIORITY

We have some of the best support in the business. We can be reached anytime of day, and will help you through any hurdles you might encounter. Need help? Call Us.

QUICK AND PAINLESS

Signing up is fast, easy, and secure. Our Application process can be completed in just a few minutes, and you’ll hear back from us within 24-48 hours, sometimes sooner!

Applying is fast And Easy

No matter your device, platform, product or service, applying is a painlessly quick experience and can be finished in minutes. So what are you waiting for? Stop delaying and start selling today!