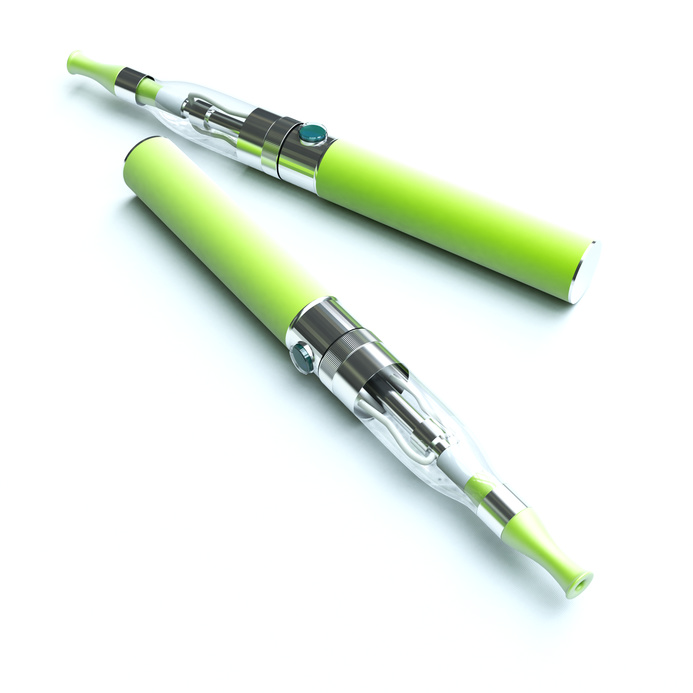

The electronic cigarette business is booming with new brands of e-cigarettes and different flavors to fill the cartridges. With the popularity of this product rising every month, the market value is in excess of $2 billion.

This makes the e-cigarette market a very popular business to enter, having customers ready to purchase the different options available. However, making payment options easy for your customers is important; consider applying for an electronic cigarette merchant account.

Putting a proposal for a merchant account is going to allow your customers to purchase items from you using their debit or credit cards, this can quickly increase the potential sales. However, if you consider an online business, this is more high risk and you would benefit from finding a merchant account that deals with a high-risk application; this prevents wasting time and having to deal with rejection. Some merchant account suppliers aren’t looking for high-risk businesses, they have the potential to lose money and this makes the risk high, a high-risk merchant account will increase the fees charged for the service to cover any potential loss.

What is important in the e-cig market is to consider the government’s position in relation to the amount of tax claimed, currently, the e-cig doesn’t fall under the same guidelines as cigarettes, but that is likely to change because of the amount of money the industry is currently making.

Making them a target in the future with rises in taxes is the right time to get into the e-cig market as a potential business opportunity.

Regulations will have the potential to slow down this market, currently, the growth and popularity of the e-cig are amazing. There are recommendations for using it as an alternative to smoking or as a way to quit smoking cigarettes. There is still some harm from ingesting nicotine and other chemicals, but they are less harmful than tobacco.

Until there are long-term studies done on the effects of e-cig on the body, there are no answers to these questions, but what is going to happen is an increase in tax paid on these products.

Therefore, it is not up to business owners to worry about the future implications of the e-cig but to understand its current potential in the retail market.

For an electronic cigarette merchant account call 1-800-621-4893

EMB are proud members of The Smoke-Free Alternatives Trade Association