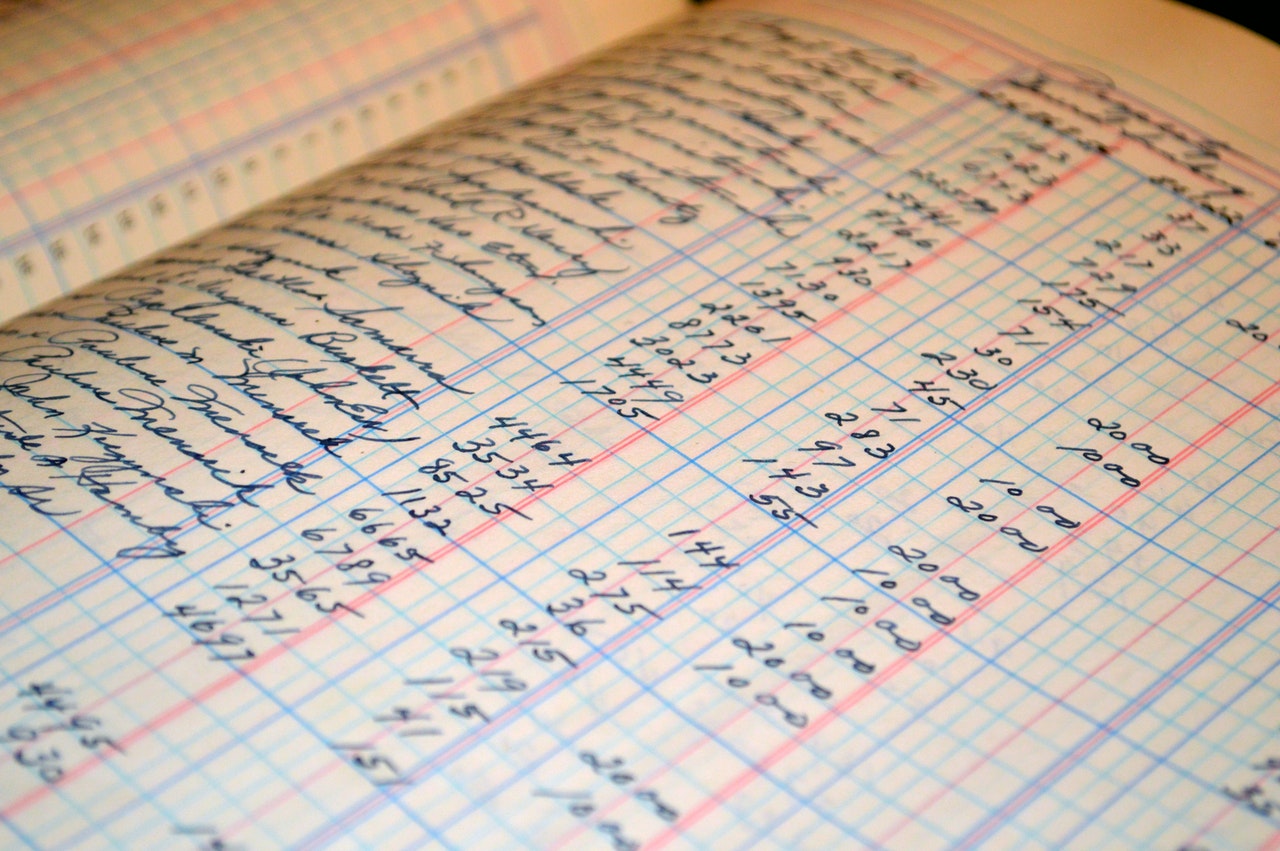

Your business relies on you to keep the accounts up to date. Only then, will you have complete control of your business and be able to plan for the future and possible expansion.

Even small businesses can benefit from a bookkeeping merchant account, keeping you in control of your finances. What all businesses should aim for is to complete the basic accounting on a daily or weekly basis, this allows for the closure of the end-of-month accounts to be a smoother process than if you are trying to add information to the system before closing the monthly accounts.

This reduces the pressure at the end of the financial year when you are preparing accounts for the tax requirements. It can give you the time required to take advantage of any tax benefits that you need to apply for, before the end of the year and make any adjustments needed.

It is important that you are not running your business wearing a blindfold; this is in essence what you are doing if you are failing to prepare your accounts properly. There are tasks that if broken down during the course of the year can then make bookkeeping a simple daily process.

A business that is not up to date with its accounts is a business that isn’t focused on growing and developing. The information that you can obtain from an accurate accounts system, in terms of financial forecasting, is going to give your business more than you could ever imagine in terms of forecasting your future business plans and the potential to grow your company. It gives you access to the information that can pin-points the difficult months of the year, allowing you to accurately generate the business when you need it most.

Therefore, if you are able to attend to your bookkeeping on a daily or weekly basis you could take your business to a new level, reducing the stress at tax time, because you have already completed the hard work. Businesses both large and small need to ensure they embrace the accounts department, without which a business could quickly find themselves in difficulty and not know which way to turn.

Call us at 1-800-621-4893 or click below to be approved for a Bookkeeping Merchant Account Today!