- About Us

-

Solutions

Other ServicesThe Payment Experts

Our integrations connect you with the best tools for your business.

Integrations - Partner

-

Industries

- Online Gaming & Casinos

- Bail Bonds

- Multilevel Marketing

- Online Furniture Sales

- Bad Credit Merchant Accounts

- Calling Cards

- Moving & Transportation

- CBD Oil

- Travel & Timeshares

- TMF Merchants

- High-Ticket Accounts

- Jet Charters

- Penny Auctions

- Educational & Seminars

- VOIP and Telecom

- Online Firearm Sales

- Cigars and Pipes

- Online Ticketing Sales

- High Volume Merchants

- Debt Consolidators

- Software and E-Book Merchants

Industries - Contact Us

Easily accept payments in Bitcoin, Ethereum, and other popular cryptocurrencies

Cryptocurrency payment merchant accounts

The rapidly evolving field of cryptocurrency payments offers several advantages for merchants, including quick transactions, worldwide accessibility, and reduced risk of fraud.

Reasons to select eMerchantBroker for help with cryptocurrency

Security

Cryptocurrency payments are more secure than traditional payment options due to their decentralized and encrypted nature, reducing the risks of fraud and hacking.

Fair review

Our review process helps to make sure that merchants do not have any outstanding debts, negative financial accounts, or other issues.

Business growth

Selecting the appropriate type of cryptocurrency payments is vital for your business’s growth, as it increases a company’s efficiency and establishes trust among networks.

Automated payments

By automating payments, merchants can access various tools addressing consumer behaviors and sales, while also guaranteeing fast and seamless payment processing.

- How to Choose the Best Bitcoin Payment Processor for BusinessOverview of Bitcoin Payment Processor Bitcoin Payment Processor is a third party company providing bitcoin… Read More »How to Choose the Best Bitcoin Payment Processor for Business

Benefits offered by utilizing cryptocurrency payments

Cryptocurrency is much more than a trend. Many people view cryptocurrency as the “currency of the future” and the payment method has expanded quickly in the last few years.

Reduced risk of fraud

Unlike bank transfers, cryptocurrency transactions occur either in real-time or in a short few minutes.

Worldwide transactions

Because cryptocurrency is an international payment option, merchants can accept it anywhere in the world.

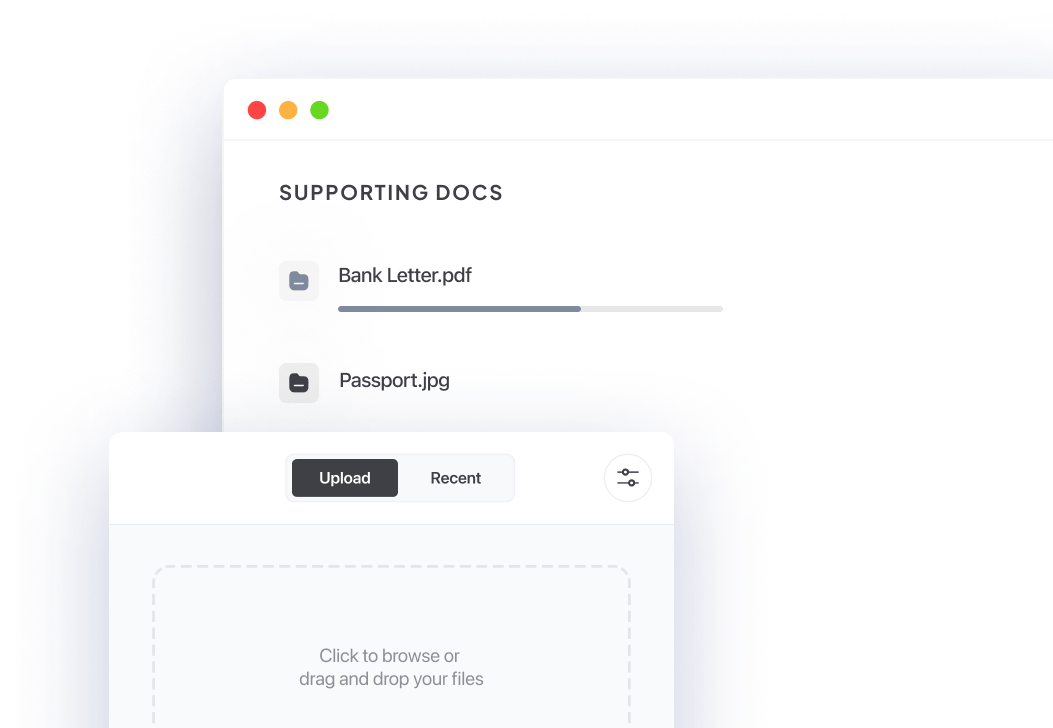

What documents are required?

If you are a merchant prepared to begin receiving cryptocurrency payments, you must provide several important documents. Copies of the following information are then submitted to our processors in addition to our quick and easy online application:

- Bank letter or confirmation of deposit bank info

- Copy of passport or ID

- One month of business bank statements (if available)

- Corporate documents

Start exploring the benefits of cryptocurrency payments today!

A wide range of industries can benefit from cryptocurrency payments

How EMB has helped others

“Since EMB helped us make our sales transactions easier and quicker with cryptocurrency, we’ve noticed several of our competitors begin to offer cryptocurrency options too. This makes us look innovative and cutting edge to our patrons.”

A firearm dealer Grower.io

“After implementing cryptocurrency payment options, we’ve noticed that potential purchasers abandon shopping carts much less often. As a result, we’re seeing increased conversions and more transactions.”

An artwork seller DLDesign.co