- About Us

-

Solutions

Other ServicesThe Payment Experts

Our integrations connect you with the best tools for your business.

Integrations - Partner

-

Industries

- Online Gaming & Casinos

- Bail Bonds

- Multilevel Marketing

- Online Furniture Sales

- Bad Credit Merchant Accounts

- Calling Cards

- Moving & Transportation

- CBD Oil

- Travel & Timeshares

- TMF Merchants

- High-Ticket Accounts

- Jet Charters

- Penny Auctions

- Educational & Seminars

- VOIP and Telecom

- Online Firearm Sales

- Cigars and Pipes

- Online Ticketing Sales

- High Volume Merchants

- Debt Consolidators

- Software and E-Book Merchants

Industries - Contact Us

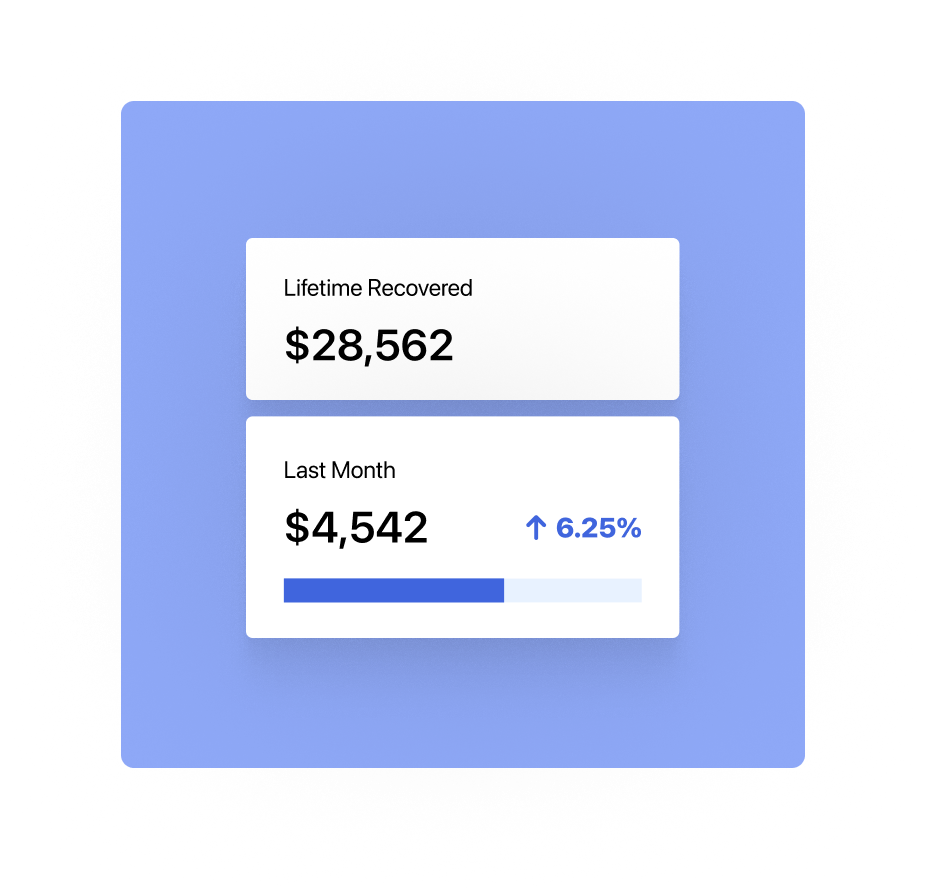

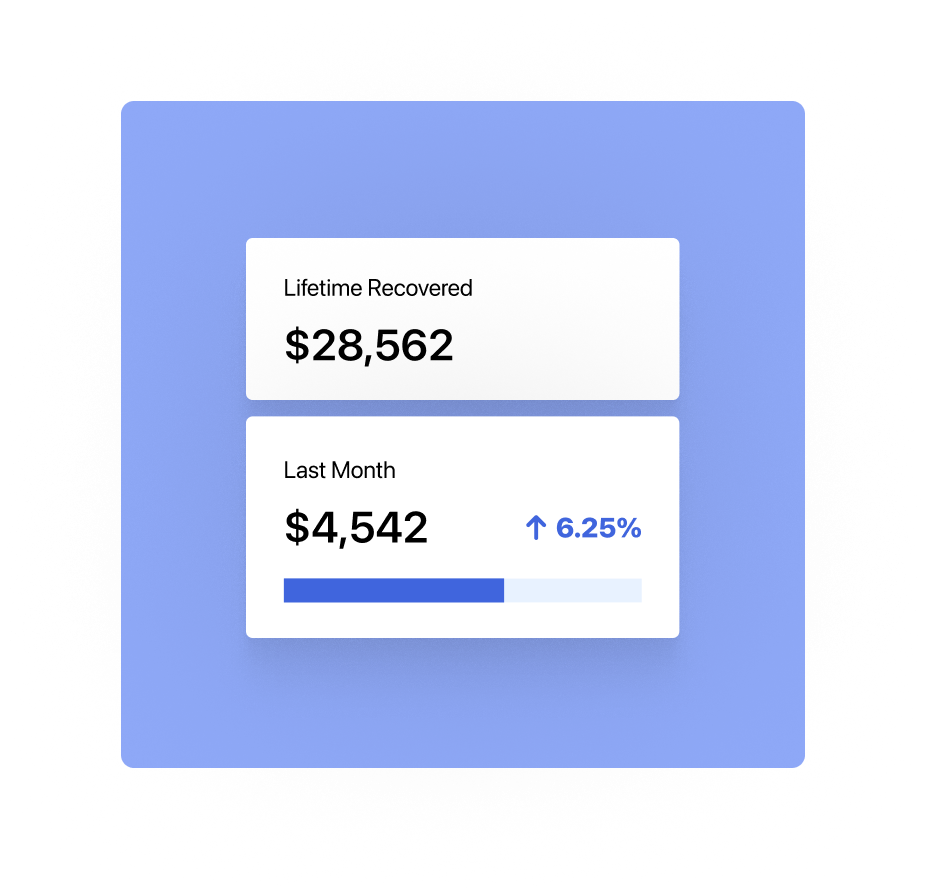

Protect your finances with our chargeback protection service

Chargeback protection

Our chargeback protection service helps you dispute any unauthorized or fraudulent charges made on your card. We’ll work with your bank or credit card company to get your money back and protect you from future fraudulent charges. Don’t let fraudulent charges drain your account! Our chargeback protection service helps you reclaim your money, ensuring your finances are always secure.

The advantages of EMB’s chargeback program

Lower your number of chargebacks

Our chargeback mitigation program helps merchants reduce chargebacks by 25%. Merchants with our program can even prevent 3 out of every 12 chargebacks.

Increased control over chargebacks

EMB works with Ethoca and Verifi. We’ve also created a chargeback alert system. This offers a level of control not offered by our competition.

High-risk and new merchants welcome

Many high-risk and new merchants are turned away from other chargeback mitigation programs. At EMB, we assist many clients with either bad or no credit history.

Simple to understand

EMB’s chargeback program helps merchants fight and reduce fraud. The program is also simple for merchants to understand.

- Mastering Credit Card Processing for High Risk MerchantsEffective credit card processing for high risk merchants is pivotal in order to sustain and… Read More »Mastering Credit Card Processing for High Risk Merchants

The challenges created by chargebacks

Whenever a customer contacts a credit card company about charges, merchants often end up paying the consequences. Each year, companies pay a substantial amount to contend with fraud.

- Financial challenges. Too many chargebacks can lead to difficulties securing certain licenses and obtaining additional financing.

- Damaged reputations. Businesses that accrue a large number of chargebacks can end up having their financial reputation damaged and find their growth stifled.

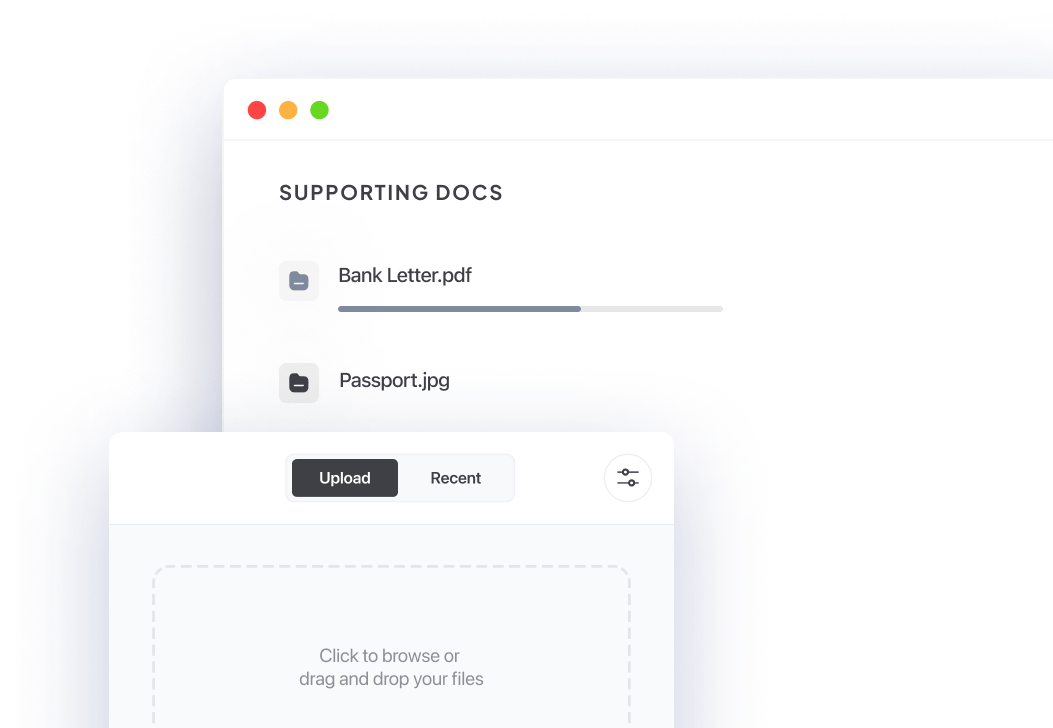

What paperwork is needed to apply to EMB?

Businesses interested in utilizing EMB’s services should both fill out our application and submit the following requisite documents:

- A bank letter or voided check

- A chargeback ratio less than 2%

- Three months of bank statements

- Three months of processing statements

- A Social Security or Employer Identification number

- A working website

- Valid identification

Protect your business from chargebacks and secure your revenue today

The most trusted name in chargeback protection and fighting chargeback fraud.

We’ve helped business in various industries respond to chargebacks

“Chargebacks were having a negative impact on the growth of our business. With EMB’s help, we’re on the way to reaching our full potential.”

Anonymous, credit repair

“We were experiencing a lot of chargebacks because jewelry is expensive and some of our customers ended up regretting their purchases. EMB helped us implement various techniques to lower the number of chargebacks.”

Anonymous jewelry seller