Give business a boost with a hair wig merchant account

A hair wig merchant account can help your business accept credit card payments, streamline your sales process, and improve your customer experience.

Products in the wig and hairpiece industry

EMB approves hair wig merchant accounts for eligible businesses that sell a range of products, including:

- Extensions

- Wigs

- Lashes

- Toupees

- Detangling brushes

- Dry shampoo

Applying for a THSHW merchant account is still quick & simple

No application fees

Don’t worry about extra fees or hidden start up costs when applying for a second chance TMF merchant account.

Competitive rates

EMB believes that all businesses deserve customized solutions at competitive rates.

No credit card required

There’s nothing standing in your way from starting your quick application, not even a credit card!

Secure gateway options

Avoid financial missteps with protective measures with your TMF merchant account.

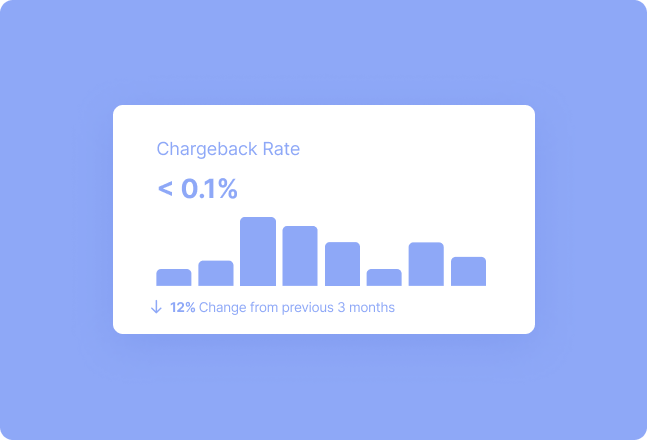

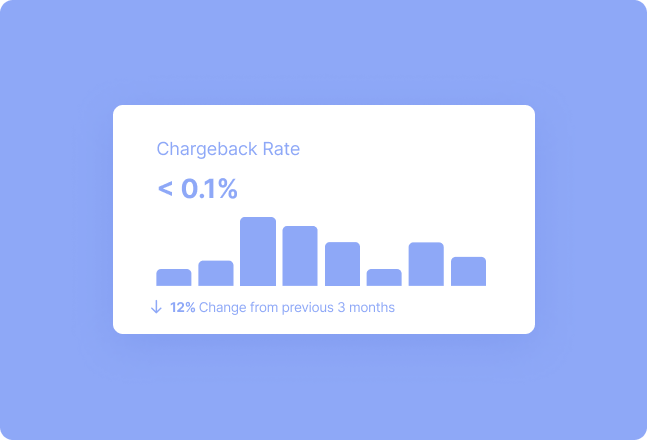

Determining a

chargeback ratio

A merchant’s chargeback ratio is calculated by the number of chargebacks divided by the number of monthly transactions. For example, a merchant with 300 transactions and 12 chargebacks in a month would have a 4% chargeback. The reason or the dollar amount of a chargeback doesn’t matter to credit card processors.

Documents needed to get a hair wig merchant account

- A valid, government-issued ID, such as a driver’s license or passport

- A bank letter or a pre-printed voided check

- Three months of the most recent bank statements

- Three months of the most recent processing statements, if applicable

- A SSN (Social Security Number) or EIN (Employer Identification Number)

Don’t let payment processing hold you back: get a hair wig merchant account now

- Absolutely 0 hidden fees

- 99% approval rating

- 24/7 customer support