- About Us

-

Solutions

Other ServicesThe Payment Experts

Our integrations connect you with the best tools for your business.

Integrations - Partner

-

Industries

- Online Gaming & Casinos

- Bail Bonds

- Multilevel Marketing

- Online Furniture Sales

- Bad Credit Merchant Accounts

- Calling Cards

- Moving & Transportation

- CBD Oil

- Travel & Timeshares

- TMF Merchants

- High-Ticket Accounts

- Jet Charters

- Penny Auctions

- Educational & Seminars

- VOIP and Telecom

- Online Firearm Sales

- Cigars and Pipes

- Online Ticketing Sales

- High Volume Merchants

- Debt Consolidators

- Software and E-Book Merchants

Industries - Contact Us

Apply today, be in business tomorrow

Merchant account services

EMB offers merchant account services with low fees, increased savings, and 24/7 customer support. Merchant accounts allow your business to accept credit and debit cards online. EMB is a proven industry leader. With EMB’s merchant accounts, clients realize many advantages such as increased savings and award-winning customer support.

Benefits of EMB for merchant account services

Various services offered

We help merchants safely and securely process credit card payments for merchant accounts. We offer assistance to both mail order/telephone order (MOTO) and internet-based businesses.

Affordable rates

EMB offers affordable credit processing rates. To save on costs, we offer ACH processing, secure payment gateways, and chargeback prevention programs.

Up-to-date information

Credit card processing regulations are complex. Our staff works hard to provide clients with up-to-date and accurate information.

Proven platform

We’ve constructed a platform designed to work for you. We add new features all the time to meet our client’s unique needs.

- Is A Nutraceutical Merchant Account Considered High Risk?The global healthcare landscape is evolving, with an increasing emphasis on wellness and prevention. One… Read More »Is A Nutraceutical Merchant Account Considered High Risk?

Reasons to think twice about merchant accounts with banks

Many banks offer merchant accounts, but there are several reasons why businesses should think carefully about pursuing these options.

- Fixed prices for bank services. Banks often offer packages, which carry fixed prices higher than account providers.

- Monthly credit card caps. Banks routinely place caps on credit processing volume, which can negatively impact business growth

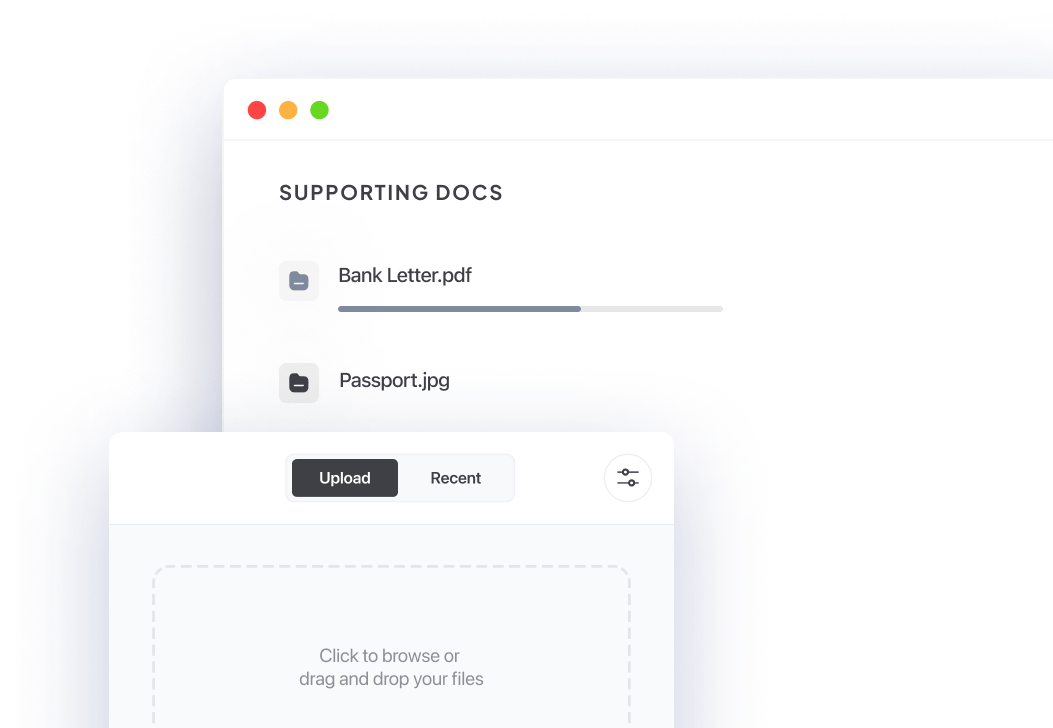

Paperwork needed for a merchant account

We strive to make the application process for merchant accounts as simple as possible. In addition to applications, candidates should provide the following:

- Valid identification

- Three months of bank statements

- Three months of processing statements

- A Social Security or Employer Identification Number

- A secure working website

- A less than 2% chargeback ratio

- A voided check or bank letter

Maximize your business potential with our merchant accounts. Start accepting payments today!

At EMB, we offer unique solutions to meet your business’s unique needs.

We offer merchant account services to various kinds of high-risk merchants

Merchant accounts for clients in high-risk industries

“With eMerchantBroker’s services, we’ve been able to provide our students with safe and secure payment processing. We even offer several payment types.”

Anonymous, online education client

“We first applied for a merchant account, but were rejected. EMB ended up offering us a wider variety of options for merchant accounts than the bank would have.”

Anonymous a furniture client

To get a merchant account, apply through a reliable provider like EMB. EMB offers easy application processes, affordable rates, various services, and 24/7 customer support for businesses to accept credit and debit cards online. The application process typically requires submitting an application along with valid identification, three months of bank statements, three months of processing statements, a Social Security or Employer Identification Number, a secure working website, a less than 2% chargeback ratio, and a voided check or bank letter.

An online merchant account is a type of account that allows businesses to accept credit and debit card payments through their website. EMB offers merchant account services tailored for online businesses, ensuring safe and secure payment processing, affordable rates, and award-winning customer support.

Merchant account solutions help businesses accept credit and debit card payments online. These solutions include secure payment gateways, ACH processing, and chargeback prevention programs, making it easier and more affordable for businesses to process online payments.These services are offered by providers like EMB.

Merchant accounting services include various services offered by providers to help businesses manage their finances, such as payment processing, account management, and financial reporting. EMB offers a range of merchant accounting services tailored to meet the unique needs of businesses, ensuring they can securely and efficiently process online payments.

To apply for a merchant account with EMB, follow the online application process, which requires submitting necessary documents such as valid identification, bank statements, processing statements, a Social Security or Employer Identification Number, a secure working website, a less than 2% chargeback ratio, and a voided check or bank letter. EMB strives to make the application process as simple as possible for businesses to start accepting online payments.

Still have questions?

If you can’t find the answer you’re looking for, please reach out and chat with our team.

Get in touch