Introducing Atlas

The world’s first digital application designed specifically for merchant services agents & ISOs.

Meet Atlas. Our full-featured online

agent portal and custom user app.

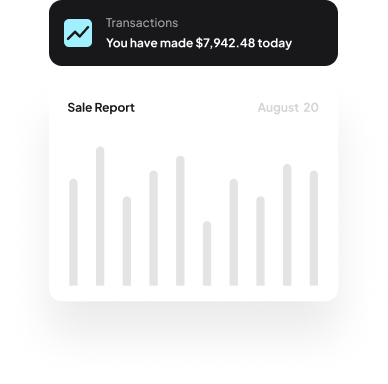

Reporting

Stay up-to-date with all the data that counts. Full reporting platform gives you insight into all of your deals!

Real-time Notifications

Monitor communications in real-time; access notifications from administration and operations team members as they happen!

Built for Merchant Services

We built our app from the ground up, to manage the many varying requirements and idiosyncracies of high-risk payments. It’s the first portal built just for our industry.

Make it easy for your merchants and agents

Our intuitive online application was designed by merchant services agents for merchant services agents. You or your agents can fill out most of the application details before sending an application email or walking into an application meeting — drastically shortening the process and saving you both time and money. And that’s not all.

Easily keep track of underwriting and onboarding

- See which merchants are in which stage at anytime

- Respond to underwriter inquiries for individual accounts instantly

- Handle all underwriter correspondence directly within the dashboard

- Expedite the underwriting process by working directly with EMB’s team through Atlas

With Atlas’ online application system

- You can fill out most of the application details before your meeting, drastically reducing the time it takes to sign a new account.

- Merchants can save their progress and come back. You’ll reduce time-costly errors, which increases turnaround time.

- Owners can electronically sign the document from anywhere in the world. Yep, no more faxing. Multiple users can complete the application together, and Atlas keeps thorough records of every action.

- You can easily input ownership stakes, set-up fees, individual processing percents, and more. You can export the application as a PDF or send it to EMB’s underwriters with a click of a button.

With Atlas’ Merchant CRM, built for ISOs and agents, your business will enter a new world of productivity.

- Keep track of how many merchants you have and the residuals you’re earning from each.

- See which merchants are in which stage and respond to underwriter inquiries for individual accounts instantly.

- Quickly access merchant account ID numbers.

- Create individual users for each separate account. This is great for ISOs or agencies with multiple employees.

Our pricing strategy will always be to provide

a better and cheaper alternative.

- No hidden fees

- 99% approval rating

- No credit card required

Join 3,200+ business owners now

You’re one click away from simple payment and funding solutions

Having a merchant account allows an account holder to take advantage of merchant cash advances. When a merchant is approved for an advance, the business agrees to receive a lump sum of cash in exchange for an agreed-upon percentage of future credit card sales.

Pricing varies depending on the merchant’s industry, past credit card processing history, the type of business seeking the account, average ticket sales, and average transaction volumes.

Yes, EMB works with merchants who are building their credit, as well as those who have poor credit. EMB also approves merchants that have no credit card processing history and businesses that have lost their merchant accounts due to high chargebacks.

Several factors influence a merchant’s risk level. Though only one factor likely will not get a merchant classified as high risk, a combination of these may: business size, location, and industry, credit score, credit card processing history, a industry’s reputation for excessive chargebacks, a prior history of high chargeback ratios, and whether a merchant exclusively sells online.

Virtual terminals are stationed on a merchant’s website, making it easy for customers to make a payment or purchase online. Merchants or a payment processor can easily set up virtual terminals, so online businesses can accept credit and debit card and e-check transactions.

A merchant account is a business account with an acquiring bank. Without this business account, which actually works more like a line of credit, a merchant cannot accept and process credit and debit card transactions. Businesses need a merchant account to accept major credit cards via a static point-of-sale terminal, mobile card reader, or through a virtual payment gateway.

After filling out EMB’s simple online application and submitting any necessary, requested documents, many merchants get approved within 24 and 48 hours.

EMB specializes in working with high-risk merchants. EMB works with many merchants, including but not limited to businesses in these industries: gambling and gaming, adult entertainment, nutraceuticals, vaping and e-cigarettes, electronics, tech support, travel, high-end furniture, weight loss programs, calling cards, e-books and software, and telecommunications.

Still have questions?

If you can’t find the answer you’re looking for, please reach out and chat with our team.

Get in touch